Revealing Audience Quality Prior to Launch

So clients can spend more time optimizing messaging and cross channel marketing strategies that engage the ideal patient population

Real World Data-driven audiences enable marketers to reach the right patients, leading to successful campaigns. Without this awareness a message can’t be appropriately delivered, which means it won’t resonate or result in activation. This is the equivalent of throwing an object at random and expecting it to land in a specific location.

Instead of casting the widest net, advertisers should leverage custom audiences and target known de-identified patient populations. These patient segments can then be activated directly in the channels they’re most receptive to. Armed with this information, marketing teams can get specific and address patient segments directly. For instance, those who have yet to start a therapy or have been taking a competitive drug for 5+ years, or patients that want to convert and have a history of nonadherence. In short, custom audiences enable custom messaging, which is more likely to result in patients being motivated to take an active role in their health journey, leading to better outcomes overall.

For too long, marketers have been operating off guesses, estimates and assumptions. However, the current health marketing landscape requires that advertisers think strategically and understand the issues with standard targeting while being prepared for a fluctuating privacy-centric landscape. Swoop is filling in these gaps through real world data (RWD) – our segments have the highest legally allowable percentage of de-identified patients, including those with sensitive and rare/specialty conditions, based on actual claims data .

Here’s how to maximize constrained budgets by capturing a higher audience quality (AQ) and generate increased sales just by changing your outreach approach.

Traditional patient audience segments include demographic data, off-the-shelf segments and behavioral/clickstream data.

Despite being a go-to approach for many, demographic data, clickstream/behavior-based engagement and off-the-shelf segments reveal too little about patients and are not targeted enough to maximize campaign effectiveness.

The result of improper targeting is simply, nothing. An undifferentiated message that broadly reaches too many or even the wrong patients, who never actually engage with health care providers, seek treatment for their condition and commit to a line of therapy. In other words, connecting with the right audience is everything.

Demographic data is the measure of a population divided by criteria such as socio-economic status, education, nationality, ethnicity, religion and gender.

What are the shortcomings of demographic data?

Though an industry standard, demographic data oversimplifies groups based on age, gender, ethnicity and household while failing to consider applicable health conditions. The result is a generalized message that doesn’t penetrate the right consumers or won’t resonate with those who are. Following the logic of demographics-based campaigns, an advertisement for a breast cancer drug will target women over 40 – and stop there. Yes, this group might be loosely associated with the condition, but the majority will tune out. And this tactic is especially ineffective for rare and specialty diseases, as these patients do not fit neatly within any bracket.

A nine-digit zip segment is an extension of the traditional five-digit zipcode. The first two digits designate a sector or several blocks, while the last two digits indicate a segment or side of the street. The nine-digit zip is used by businesses only and in addition to conveying regional information, may reveal demographic information (such as median income and race) as well as psychographic selections gathered from mailing lists.

What are the shortcomings with zip-nine segments?

Where an individual resides does not correspond with their health status. While region can be factored in as a social determinant of health, it is not enough to accurately identify an addressable patient.

An off-the-shelf segment consists of a generic audience that may satisfy one or more requirements to be categorized together, such as sharing a zip code.

What are the shortcomings with off-the-shelf segments?

Marketers that rely on off-the-shelf segments are addressing the same individuals as their competitors. This is a failed solution as audiences that are exposed to redundant or oversaturated messages are more likely to be fatigued and ignore campaigns entirely, especially over the long term. Trying to activate undifferentiated segments is a missed opportunity to communicate key brand needs to the right patients.

Clickstream data includes all the information gathered through a users’ online and mobile activity, including how they interact with a web page, what they do after visiting a web site, and the path they take on apps. This activity is collected through a tracker javascript tag that is saved on a collection server and is available for purchase.

What are the shortcomings with clickstream data?

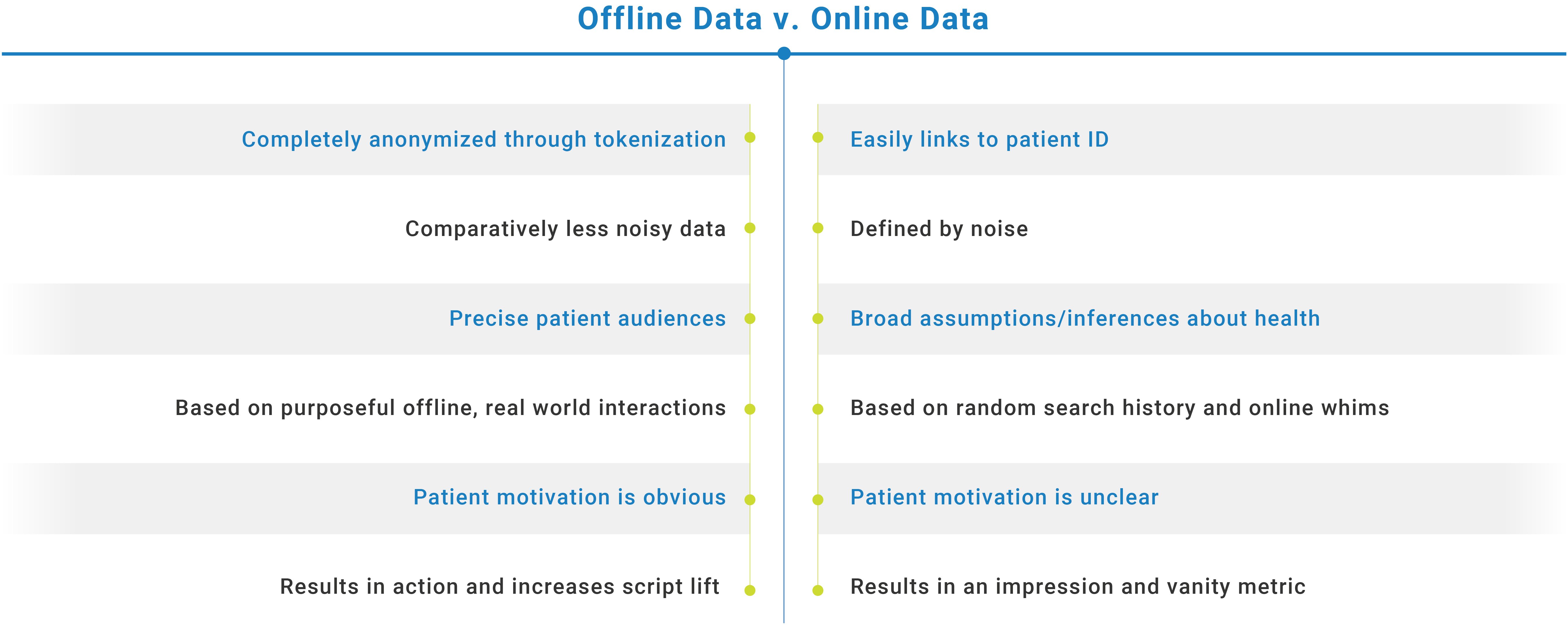

Social footprint, digital body language and clickstream data are defined by noise and cannot clearly reveal a patient’s health status. Even if all barriers were removed, online activity is at best a supplementary segmentation source. However, the biggest issue with this approach is that data gathered online — whether apps, social or search history — link directly to a user’s ID, easily compromising patient integrity.

A social footprint is a record or trail of every user interaction on social media, from commenting on an Instagram post, to uploading a job history on LinkedIn, uploading an album on Facebook, creating a board on Pinterest and sharing a personal update on Twitter, to liking a YouTube video.

What are the shortcomings with social footprint?

A social footprint is easily traced back to an individual user without any embedded privacy protection, regardless of what health information is shared. While this is not illegal since social information is largely public, Facebook recently put a stop to targeting based on health conditions – and companies such as Google and Apple have also implemented new privacy measures. This has made social media targeting less accessible to marketers. As this approach is viewed negatively by the public, it’s best not to compromise a brand’s reputation by continuing to target through social footprint.

Digital body language is how a user navigates or interacts with online content. By tracking data including clicks/opens, time spent on a page, scrolls, form submissions, times of the day most active and more, it’s possible to extract information on user behavior, including where they are in their buying journey, information on their persona, and areas of interest.

What are the shortcomings with digital body language?

Although potentially informative as a supplementary source, digital body language is not robust enough to confirm an individual’s health status (they could be searching for a relative or research paper, for example) and again, is not privacy-safe.

Sensitive health conditions carry higher risks if disclosed including discrimination, social stigma, or physical harm — these risks may also extend to a patient’s family, social network or employer. Sensitive health categories include mental and reproductive health, domestic violence, genetics, cancer, untreatable disease predominantly affecting children and substance abuse. While the federal HIPAA Privacy Rule does not distinguish between health conditions, the Network Advertising Initiative (NAI) does.

Non-sensitive conditions are more prevalent and less stigmatized, for example allergies or acne. This can also include higher-level “lesser” health categories such as weight loss or cholesterol management that do not require a specific opt-in (according to the NAI) when targeting patients.

The sensitivity of a condition, treatment or even interest is based on how serious the condition is, as determined by its prevalence rate, treatability, and if the average person would consider it to be private, as well as whether it can be treated through a lifestyle modification or if it requires medical intervention.

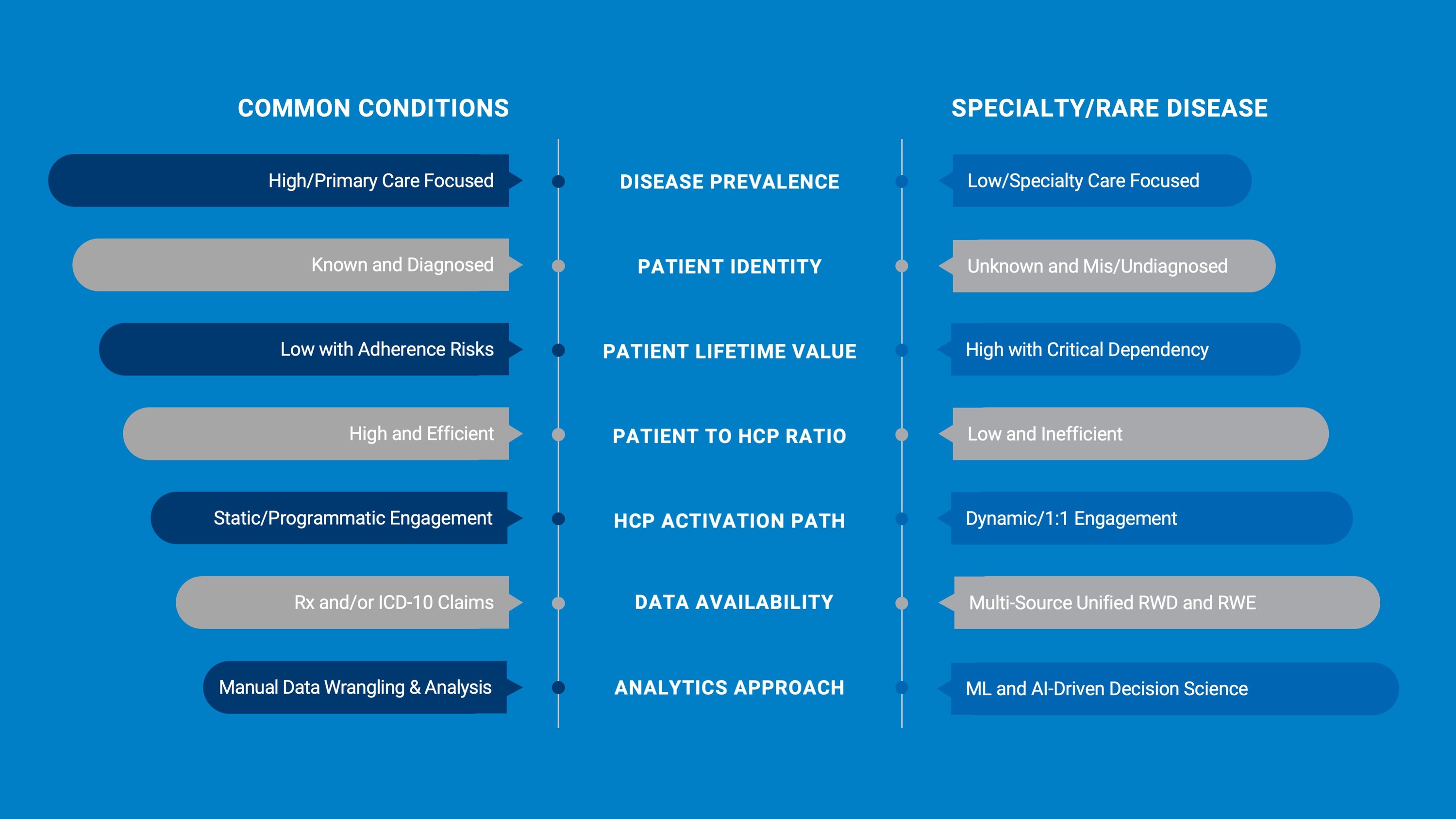

Common conditions are easy to diagnose, affect many and have available treatments, such as influenza, asthma, diabetes, arthritis and high blood pressure.

Rare and specialty diseases are defined by low prevalence, niche patient populations that are often undiagnosed or misdiagnosed and sadly, approximately 95% of these conditions lack viable therapies.

A sophisticated ML/AI partner such as Swoop can create segments that enable marketers to reach patients with any illness, including specialty and rare — even if the condition lacks an ICD-10 code. These audiences can be addressed through personal promotion and can even be directed to conversational AI agents that allow them to discuss their care in a live privacy-safe chat.

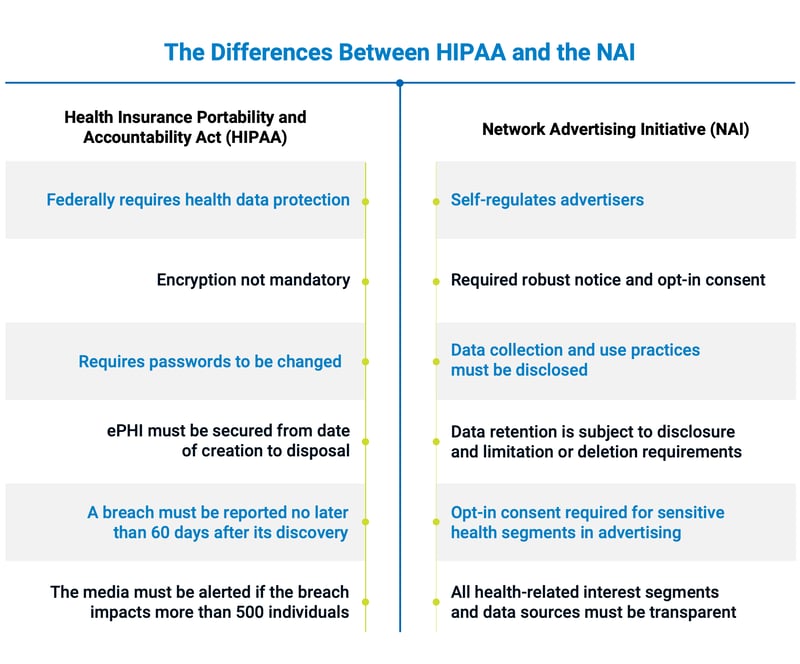

Ratified in 1996, the Health Insurance Portability and Accountability Act (HIPAA) regulates how protected health information (PHI) is handled. HIPAA generally prevents the disclosure of PHI without a patient’s consent, barring a few key exceptions such as for the benefit of the public, in circumstances related to law enforcement or government and for certain research.

With respect to DTC marketing efforts, there are several ways to breach HIPAA, even inadvertently. For example, if a patient completes a contact form or survey on a health website that in any way indicates a diagnosis, it must be protected as PHI.

As HIPAA was not created exclusively for targeted advertising, certain ambiguities prevail — although HIPAA certification attests if a data set is de-identified, it does not guarantee privacy within the segment itself. The most obvious example is if a condition-specific segment consists of a single person and that person receives an ad, it’s clear they have the disease.

HIPAA & Patient Privacy

HIPAA certification attests that the entire data set is de-identified

But a HIPAA certification does not guarantee a segment itself maintains patient privacy

Swoop maintains its commitment to patient privacy through k-Anonymity

Founded in 2000, the Network Advertising Initiative (NAI) is a self-regulating body that builds on HIPAA by going a step further, providing specific guidance for health advertising. The NAI’s Code of Conduct is regularly updated to reflect relevant technologies and developments; it was last updated in 2020 to address health data segments and sensitive conditions.

NAI requirements are stringent and include an annual review by a member of the compliance team. Opt-in consent is required for the use of Personal and Device-enabled Identifier Information (PII/DII). Furthermore, all data collected, used and retained must be transparent. If it originated from an unqualified source, it won’t pass the audit. This purposeful system built on explicit patient permission assures privacy in all advertising environments and provides direct guidance on patient audiences for targeted marketing.

Advertisers that breach patient privacy risk their reputation and may be subject to further legal penalties. No matter how superficially cheap an audience segment might be, it’s never worth the cost of jeopardizing an entire brand.

The easiest way to ensure privacy-safe patient segments is to work with an NAI accredited vendor. Swoop is the first health data technology company to become a member of the NAI.

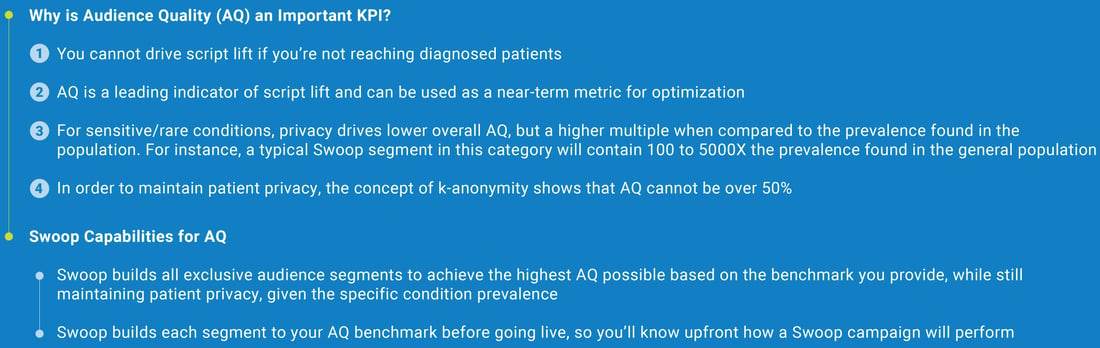

In addition to being NAI-accredited, we are HIPAA-compliant and embed our proprietary k-anonymity process — a scientific way to de-identify patients — into every custom audience we create. A segment of one is impossible with k-anonymity, which requires data sets of at least two people — 50% is the maximum allowable audience quality (AQ) — to keep identities confidential. Although AQ cannot surpass a 50% prevalence rate, our segments typically include more than 100 to 5,000 times the number of patients found in the general population.

Patient Privacy & k-Anonymity

k-Anonymity provides a scientific guarantee that the individuals who are subjects of the data cannot be re-identified

To meet this standard, each person in a segment cannot be distinguished from at least k-1 individuals who also appear in the data

This means that k must equal at least 2, which means 50% would be the maximum Audience Quality (AQ)

The lower the prevalence the higher the k. For instance, you would want to have k=2 for a specific zip code

Health marketers that mostly target based on clickstream data are facing an industry in flux. Platforms that many have relied on for decades, including Facebook, Apple and Google, all recently announced sweeping privacy changes that impact how advertising is done, summarized below and linked to further information. This new, industry-wide focus on privacy further complicates traditional patient outreach tactics.

HOW IS THE HEALTH MARKETING LANDSCAPE CHANGING?

Health marketers that mostly target based on clickstream data are facing an industry in flux. Platforms that many have relied on for decades, including Facebook, Apple and Google, all recently announced sweeping privacy changes that impact how advertising is done, summarized below and linked to further information. This new, industry-wide focus on privacy further complicates traditional patient outreach tactics.

On January 19, 2022, Facebook eliminated ad targeting based on sensitive interests, including health. This blocks marketers from targeting users through their interactions with content such as “World Diabetes Day” or belonging to “lung cancer awareness” or “chemotherapy” groups. While targeting via Facebook interests was an affordable go-to marketing tactic for a decade, it is now gone, and many are searching for ways to compensate.

Apple’s iOS 14.5 update prompted users for their permission to be tracked across apps (called App Tracking Transparency) – the majority of users declined. This has hurt advertisers that rely on platforms like Facebook to deliver targeted ads. Facebook/Meta tried to retaliate against Apple but to no avail – the decision has caused its stock to fall approx. 45%. Meta is working on a way around ATT but there’s no solution yet.

Although Google is eliminating tracking via cookies, the company hasn’t figured out exactly how to do so. After “FLoC” (Federated Learning of Cohorts) failed beta testing, the company announced “Topics,” which breaks down user search history over three weeks into broad categories. Advertisers only have access to three interests, or one topic from each of the last three weeks. As details are TBC, no one knows what the “health” category will include, but it’s likely to be too generalized to effectively target. Users can also opt-out of being tracked via Topics or remove certain categories; search history is deleted every three weeks.

Google is phasing out cross-app ad trackers in Android smartphones, giving users more data privacy. The announcement, called the Privacy Sandbox, will take effect in 2024. Marketers who rely on user IDs for targeted advertising will be most impacted by the change as the new system limits third-party data sharing.

WHAT IS HEALTH CLAIMS DATA?

Health claims data includes information from doctors' appointments, bills, insurance notes and other patient-provider communications; it also covers every diagnostic code and NPI-affiliated prescription.

Health claims data generated across the entire US is delivered to Swoop on a weekly basis, which we use to create ideal patient audiences that are refreshed in near real time.

WHAT IS SDOH DATA?

Social determinants of health (SDOH) data includes conditions of a person’s environment that impact health and quality-of-life.

WHAT IS RWD?

Privacy-safe real world data (RWD) is gathered entirely offline and unifies health claims data with social determinants of health data.

WHAT IS AI?

Artificial intelligence (AI) involves the algorithms and processes that mimic cognitive human function to simulate intelligence.

HOW DOES RWD WORK?

At Swoop, this robust data universe spans more than 300 million US patient journeys spanning over ten years and 65 billion SDOH signals going back over a decade. Using a proprietary system of artificial intelligence, RWD is transformed into exclusive patient audiences.

These segments can be customized beyond diagnosis to include a range of brand-specific criteria including patients who are non-adherent, have recently been prescribed a competitive therapy, or have a defined comorbidity. The result is a more accurate understanding of who patient segments truly are, enabling more granular and direct targeting.

A vanity metric is an impression or click. Although a high number of impressions/clicks are accepted as indicators of a campaign’s success, they are largely meaningless.

Impression and clicks are passive — for impressions especially, there’s no way to confirm if the ad was even noticed. If an ad is shown to anyone outside of the target patient population, it is almost certainly ignored. Although cost per mille (CPM), or the cost of 1,000 ad impressions, has become the standard currency of the industry, impressions do not translate to conversion opportunities.

Audience quality is a measure of disease prevalence among a target audience and a leading indicator of script lift that can be used as a near-term metric for advertising optimization.

Marketers should focus on script lift, or the measurable increase of filled prescriptions that occurs after a targeted campaign is launched. When a niche patient segment is shown an ad tailored to their specific condition, they are more likely to react by intercepting in their health journey – this includes learning more about their condition, making a doctor’s appointment and ultimately filling a prescription. In this respect, script lift has the opposite outcome of an impression as it correlates with actionable engagement instead of passivity.

Marketers should be aware of this simple equation because the higher the AQ, the greater the likelihood of script lift. A campaign that addresses a targeted audience is more likely to provoke them to participate in their care. Ultimately, it’s impossible to drive script lift without reaching the right patients.

A custom audience is an ideal patient segment created based on brand-specific criteria using RWD and AI.

With custom audiences, brands can realize any ideal patient definition.

Custom DTC patient audiences are built to meet any brand-specific criteria, whether targeting rare and specialty disease patients or those with common conditions. These custom audiences can be tailored to include patients who are currently diagnosed or on a competitive treatment, for example, and factor in any lifestyle characteristics.

Custom DTC Patient Audiences / Examples

Build custom segments to target patients based on diagnosis, or a combination of diagnoses that lead to a brand's indication.

Examples:

#1 Recently Diagnosed with X (1yr lookback for 1st Dx)

#2 Diagnosed with X + Comorbidity Y

#3 Diagnosed with X + Recent Hospitalization / Doctor Visit (6 month lookback)

TREATING

Build custom segments for adherence, re-engagement and/or conquesting based on current / past treatments/procedures within a specific time frame.

Examples:

#1 Diagnosed with X + Treating Y

#2 Current user of Y Segment

#3 Lapsed User of Z (6 month lookback)

ADDITIONAL

SWOOP can incorporate additional factors in the development of custom segments, including:

• Insured / Payer • Demo / Lifestyle

Examples:

#1 M18-34 + Diagnosed with X

#2 Diagnosed with X + Aetna Medicare (part of formulary)

#3 Diagnosed with X + Drug Dependence / Abuse

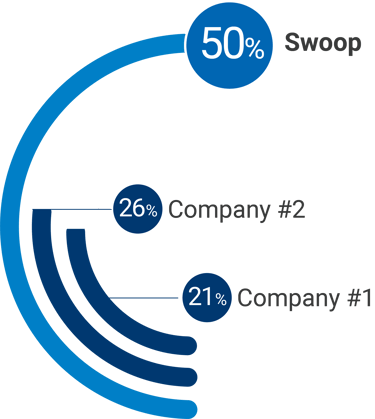

Higher quality audiences are more valuable because they lead to greater engagement. According to third-party measurements, Swoop’s brand exclusive privacy-safe patient segments outperform our competitors by 2-4 times and most importantly, drive higher script lift. Swoop’s AQ is 72% higher than the second-best performing partner.

Predictive Power in Action

Swoop audience quality was 72% higher than the second-best performing partner

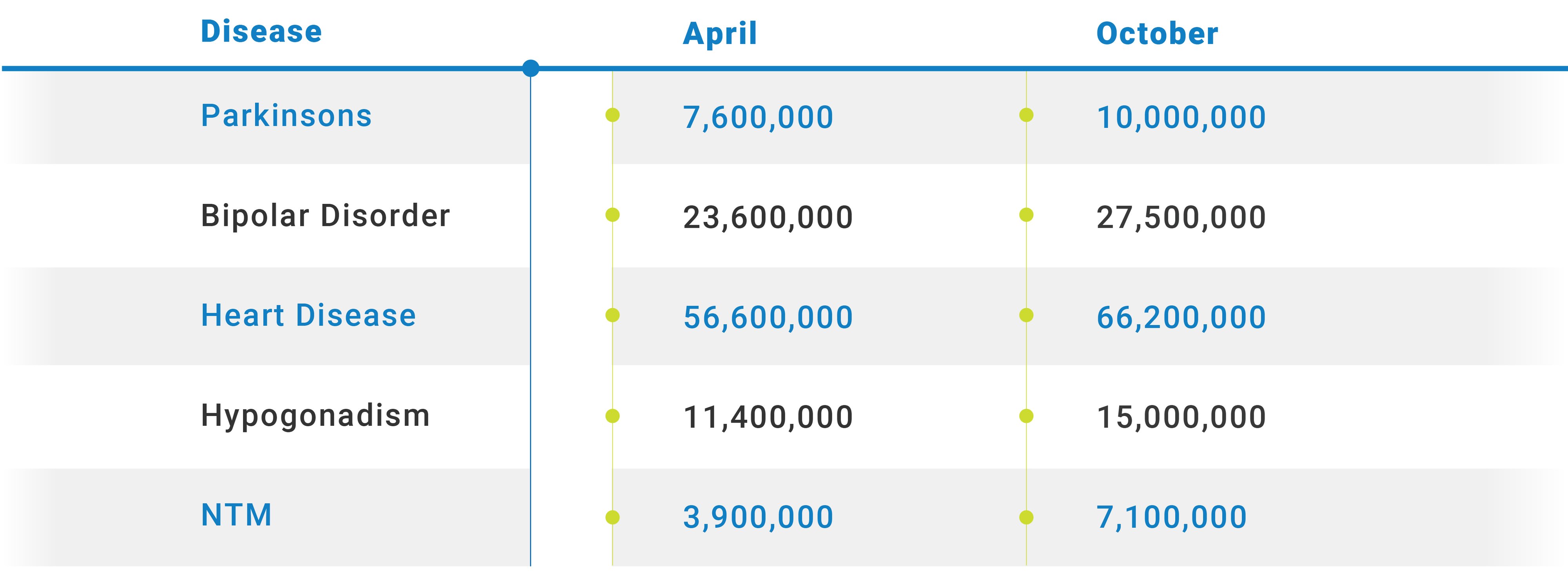

Custom audiences result in a higher ROI. Though many platforms recently experienced significant audience drop off because of new privacy permissions – according to consumer tracking firm Flurry Analytics, 96% of US users opted out of Apple’s in-app sharing – Swoop’s RWD-based segments continued to be successful. In fact, one of our primary DSPs shows that from April to October 2021, the total number of unique targetable matches to our custom audience segment markedly increased.

Abbott, a medical device and pharmaceutical company valued at $35 billion, turned to Swoop to overcome low awareness and understanding of a surgical treatment for mitral regurgitation (MR), a common though rarely diagnosed heart valve condition. The company combined powerful messaging with hyper-targeted audience segmentation for actionable results. Swoop’s reach included a digital relaunch, website refresh, integrated digital campaign across paid search, email to endemic, and programmatic display/native, as well as paid social. Upon seeing the multi-channel campaign, patients and their caregivers were motivated to act urgently and approach treating physicians about the procedure. By working with Swoop, Abbott gained a 13x return on marketing investment within months.

WHAT IS PROGRAMMATIC ADVERTISING?

Programmatic advertising relies on real time bidding and automated technology to buy ad space. This digital media buying tactic relies on data-driven insights and algorithms to show users ads on the right channel through a demand side platform (DSP). A DSP enables marketers to buy ad inventory across platforms.

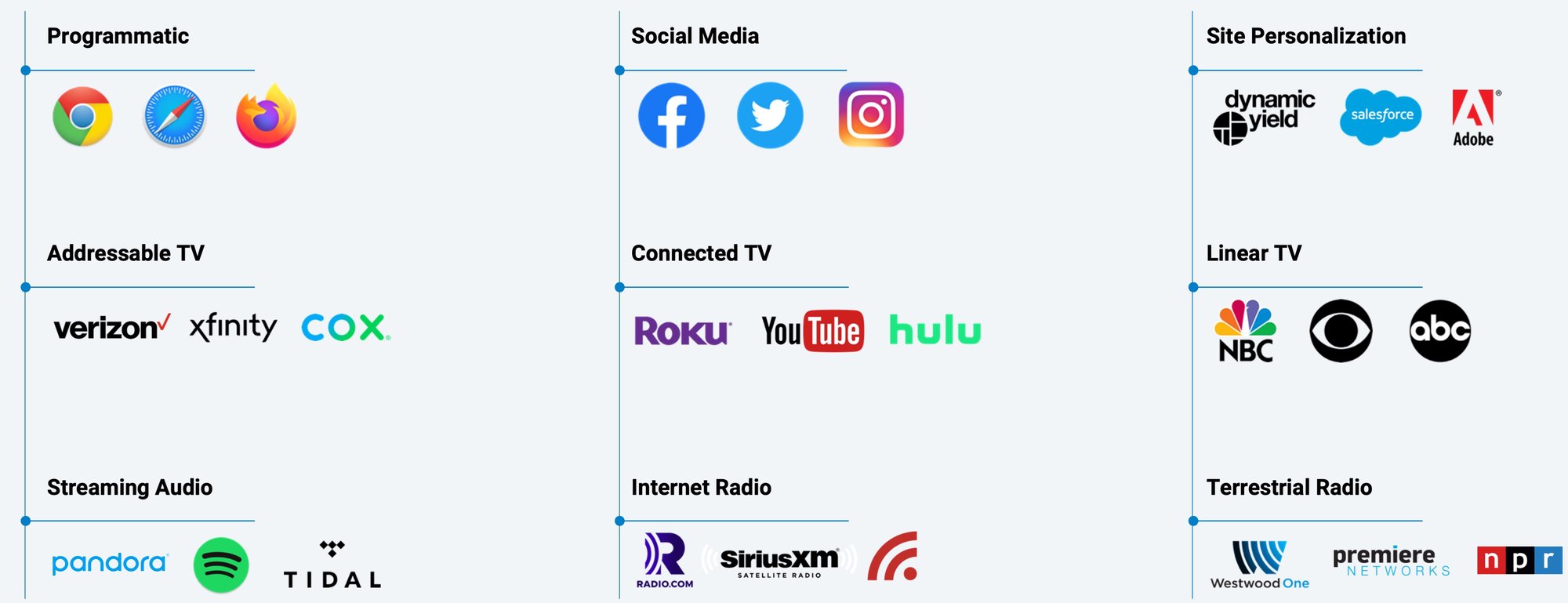

WHAT IS OMNICHANNEL ACTIVATION?

Omnichannel activation in marketing means deploying a campaign to a single audience segment across marketing channels, be it programmatic, linear TV or streaming audio.

ONE AUDIENCE FOR OMNICHANNEL ACTIVATION

WHY SHOULD MARKETERS MEASURE AUDIENCES?

Having access to a clinically derived, brand-specific audience enables health marketers to strategically target and plan, as well as activate and measure the impact of all media investment in a way that is not possible otherwise. A better touchpoint measurement allows better attribution analysis across the consumer decision journey and can be used to budget more effectively. Once it’s clear which channels aren’t performing, marketers can move away from them and save money.

WHY IS USING THE SAME AUDIENCE ACROSS CHANNELS A BENEFIT?

Using the same audience across channels is valuable for the marketing mix as patients are more likely to receive and remember a repeated message, leading to a greater ROI.

WHAT ACTION CAN I TAKE TODAY TO LEVERAGE RWD-DRIVEN CUSTOM AUDIENCES?

Healthcare marketers must talk to and audit their agency or vendor to ensure they are NAI-accredited and aren’t putting a brand at risk of a privacy leak. Instead of relying on traditional vanity metrics and an outdated approach to engagement, marketers need to know that their data partner is purpose-built to meet today’s sophisticated and fluctuating landscape. The only way to guarantee a precision-based brand exclusive segment is with tokenized RWD, transformed by AI.

The next steps marketers should take is to define their business objectives, establish KPIs (key performance indicators) and plan to measure a program to re-evaluate its impact.

Define Program and Business Objectives

What brands are you focused on for this year and beyond?

How are you currently engaging patients and their associated HCPs?

How do you measure success? Is audience quality and script lift important? Is physician- level reporting relevant?

Establish Performance Drivers

Confirm brand objectives and patient definitions

Establish key performance indicators

Confirm audience quality ranges for scale, velocity and optimization

Establish Performance Drivers

Deploy Program and Assess Impact

Schedule monthly or bi-monthly performance review session

Create process for quarterly enhancements and refreshes

Continue to validate results

Swoop can help you uncover privacy-safe, high AQ patient segments without the need for expensive upfront customizations or spend commitments. We are so confident in our custom audiences that we provide them free to prospective clients and encourage performance testing before agreeing on an omnichannel deployment budget.

Revealing Audience Quality Prior to Launch

So clients can spend more time optimizing messaging and cross channel marketing strategies that engage the ideal patient population

Providing Exclusive Segments

Based on client-specific market definitions, strategies and goals, rather than off- the-shelf/one-size fits all approaches

Creating Precision Audiences

By uncovering privacy-safe target segments of ideal patients that are higher in audience quality, increase conversion and drive Rx lift

Swoop has built more than 12,000 exclusive segments for hundreds of healthcare brands to engage common, specialty and rare disease patients. Our industry footprint is indicative of our performance, as 42 of the top 50 pharma companies and 18 of the top 20 healthcare agencies rely on us to educate patients about disease states and the therapies that may remedy their condition, as well as enable them to become active participants in their diagnostic and treatment journeys. The industry is rapidly changing around health marketers, which means it’s time to innovate. Instead of depending on tired audience targeting tactics that are now even less effective, savvy marketers should enjoy the benefits of precise patient audiences and maximize campaign budgets.

Simply, conventional HCP targeting ignores HCP engagement preferences. A typical NPI target list is built from prescribing or specialty data that treats all HCPs equally and fails to consider signals that uncover the channel, message and content they interact with— or any real-time behavior that could drive next best action. The result of blanketed HCP marketing is suboptimal engagement with your current and potential brand advocates.

Swoop’s clients have access to 1.7M+ NPI-verified HCPs,1.7M+ NPI-verified HCPs, 50,000 point-of-care locations, and ten years of patient journeys coupled with 500M+ NPI media exposure actions that indicate preferences across content, message and channel, allowing campaigns to reach the right target audience at the right time, with the right message, through the right channel.

Health marketers can target and reach high value HCPs by understanding who they are, where they are, and what they’re engaging with. Instead of outreaching to HCPs as if they are all the same, we create custom segments based on brand definitions – the same approach we take to patient-finding. Our exclusive data-driven Affinti™ Intelligence Platform enables health marketers to determine the best channel, device and message for each HCP, and can include a specific location (hospital, clinic, office or congress) as well as any event (recent diagnosis, payer/formulary, affiliation or recent prescription) to drive script lift and increase patient lifetime value.

By uncovering HCP content consumption patterns and understanding their channel preferences, it’s possible to optimize HCP engagement, including while at the point-of-care and in the EHR. Once a campaign has been deployed, advertisers can measure their audience reach, frequency and engagement across channels and strategize to achieve better results going forward.

MESSAGE CATEGORIES

Administration (Mode of Action)

Access (Cost & Coverage)

Clinical Trial Recruitment

Dosing

Efficacy

Indication/Brand Awareness

Patient Resources

Safety

Testing/Screening

Unbranded

CONTENT CATEGORIES

DIY

Weather

Social & Apps

Entertainment

News

Examples of how HCPs can be reached through more effective targeting include delivering clinical trial recruitment messaging on programmatic banners while an HCP is checking the weather, news, sports etc. Another example is reaching NPIs on your target list via CTV with safety messaging, or accessing cardiologists who are most responsive to cost and coverage messaging via email based on point-of-care.

Like today’s consumers, HCPs seek information across channels and interact with multiple forms of content. Whether online through programmatic, social media, TV, email, or in an EHR or via location – including their office or while attending a congress. Below are best approach examples for health marketers to engage HCPs on each platform, whether it’s delivering programmatic content in a fitness app or a click-to-call an MSL message on an iPhone.

PROGRAMMATIC

Swoop offers a fully managed programmatic solution as well as the only DSP-agnostic offering in the market with physician level detail (PLD) reporting.

Engage HCPs through display, video and contextual native based on individual content, message and channel preferences.

Incorporate time-sensitive triggers based on diagnosis and prescribing behavior.

SOCIAL MEDIA

Apply the same ideal HCP audience used for programmatic activation to social media.

Engage verified HCPs, including key opinion leaders and influencers, on the most popular social media networks.

Activate via Social Native or directly in the platforms including Facebook, Twitter, Instagram and TikTok.

TELEVISION

The first HCP TV advertising solution scaled across addressable TV and connected TV/OTT.

Access over 1.7M verified HCP households and affiliated devices.

Apply the same audience used in digital channels for TV planning and activation to optimize reach and frequency.

Deliver dedicated, branded emails to providers who have an affinity for email communications.

Trigger next best action and activate providers in other preferred channels based on their engagement with emails.

POINT-OF-CARE

Target HCPs on their personal devices at point-of-care locations such as pharmacies, hospitals, clinics, urgent care, outpatient and private practice.

Better engage with no-see HCPs in their priority point-of-care locations.

Incorporate time-sensitive triggers based on diagnosis and prescribing behavior.

EHRs

Message HCPs inside of leading EHRs during the clinical workflow.

Activate the next best message in the next best channel based on EHR exposure.

Integrate into 200+ EHR systems through app modules like DxWeb and at the institution level.

CONGRESSES AND MEETINGS

Reach NPI-verified HCPs attending live medical congresses and meetings on-site and at associated hotels.

Access HCP targets who previously attended conferences including US-based medical professionals who attended meetings abroad.

The CTV promotion resulted in a 10% script lift leading to an incremental 130 New to Brand (NRx) starts within five months. Nearly $900k was generated in incremental lifetime patient value for the company, which benefited from a 12:1 ROI.

The campaign resulted in more than 500,000 impressions and greater than 2x the industry average click thru rate. This led to 8 new patient starts during the four month campaign, generating $1.6M in lifetime patient value, or a 29:1 ROI.

Engagement led to 44 New to Brand (NRx) starts and 21% script lift within ten months of promotion. This generated more than $1M incremental lifetime patient value, which was a 4.3:1 ROI.

The targeted promotion resulted in 157 New to Brand (NRx) starts, 19% script lift, more than $500,000 in incremental lifetime patient value, and a 3.5:1 ROI within ten months.

33,000 HCPs were served more than 225,000 impressions over the course of the 9 month campaign. During the campaign, writing behavior of the target audience was measured, showing lift of 53%, which generated an ROI of 5.7:1.

For more information, an initial consult, a career opportunity or media request, get in touch with us.